Evergreen Newsletter

April 2021

Vaccines

Our department as of last week have given over 5,000 doses of the COVID vaccines on top our or normal workload!

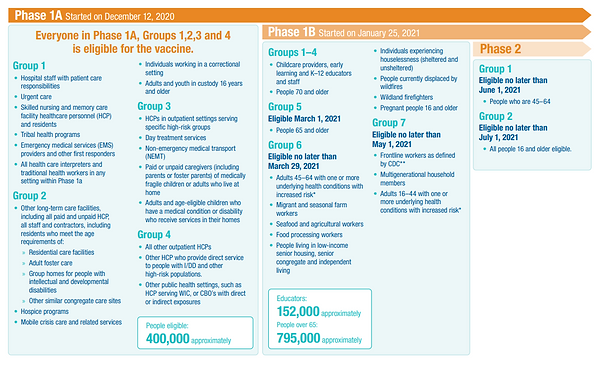

We're currently immunizing seniors 65+, and community members from groups 1a, and portions of 1b.

We're following Oregon Health Authority and Douglas Public Health's tier guidelines, the next group to become eligible is Group 6 of 1b on March 29th.

So far, we have wasted zero doses of vaccine!

Currently we are receiving shipments of both Pfizer and Moderna vaccines. Johnson & Johnson may soon be arriving; unfortunately, we have no way to estimate the timing or allocation amount of which brands we are receiving until they are shipped to us.

To schedule your COVID vaccine, please wait until your group becomes eligible to contact your PCP.

Once eligible please contact us at 541-677-6200.

School Based Health Center

South Umpqua School District and Glide School District have both agreed to participate within our School Based Health Program. We are excited to serve these districts!

Exclusion Day

We were able to offer on-site immunizations for McGovern and Brockway Elementary prior to exclusion day to limit students missing class time for doctors' appointments. The event was quick and convenient for parents and students and our staff had a blast!

What is the Advantage to a Medicare Advantage Plan?

Choosing the best Medicare plan can be a complicated process. One decision point is whether to obtain standard Medicare, along with a separate Medicare Gap Supplement, as well as a Part D plan for medication coverage. Because the option is to choose a Medicare Advantage plan which is an “all in one” simplified plan. The Medicare Advantage plan is generally less expensive than purchasing each component separately and may offer more services.

However, all Medicare Advantage plans are not equal. They vary considerably from company to company as to coverage, benefits, and cost. Most have options for various tiers of coverage. The least expensive regarding monthly premiums, is not always the best overall choice. Overall, out of pocket expense, to the patient may be more with some plans.

Some Medicare Advantage Plans cover a comprehensive physical examination by an Evergreen Provider every year. This detailed exam is provided at no cost to the patient, and every applicable diagnosis is reviewed. This exam becomes a foundation to provide a complete assessment and care plan for our patients. It facilitates better care. Standard Medicare Insurance provides for an Annual Wellness Visit directed at preventative care but does not cover an actual physical exam.

An independent insurance agent is critical in choosing the best Medicare Advantage plan for you. This service is free of charge for Medicare patients. Ask our staff or see our website for a referral to a reputable local agent.

Healthcare Education at Evergreen Family Medicine

Keeping it Rural

One of the greatest challenges impacting rural areas in Oregon is a lack of access to healthcare. Douglas County is a documented provider shortage area. Universities that provide healthcare programs are often located in larger cities. As a result, graduates of those programs often relocate to these cities and ultimately choose to stay and work in them as well. In addition to the access issues that this creates in rural areas, those students with deep roots within their community are often conflicted with staying or pursuing their education.

At Evergreen Family Medicine, we are committed to providing an opportunity for these students to complete their clinical rotations within our rural community. In-turn, these students often choose to stay and practice medicine here.

“Talent is equally distributed, opportunity is not.” Leila Janah

Currently Evergreen offers clinical rotations in the following healthcare career paths: Medical Assisting (MA), Nursing (LPN & RN), Nurse Practitioner (NP), Physician Assistant (PA), and Physician (MD & DO). We also offer an in-house training career path for Medical Assistants resulting in certification. We have trained and certified over 50 Medical Assistants and those within our program have tested at a rate 20% higher than the national average. We consider every clinical rotation as an opportunity to foster a love for rural medicine. In addition to advancing education, our goal is to keep healthcare professionals, or even draw them to, a community that we are very fortunate and proud to serve.

Over the past several years, we have had the pleasure of working with many fantastic students from the Pacific University Physician Assistant Program. We were proud to receive the Clinical Site of the Year Award in 2019 from Pacific University, which honored our PAs and MDs for providing outstanding teaching and shared expertise to their students. Several of our PAs first joined our team for clinical rotations including Pacific graduates: Matthew Stark PA-C and Chenelle McCaskill PA-C, OHSU graduates: Scott Goebel PA-C, Michael Graham PA-C, and UC Davis graduate: Kaitlyn Bogardus. We are impressed every year with caliber of the Pacific University PA Students.

During your next visit, you may encounter one of our students. The interaction that they have with you will provide a foundation that will allow them to serve our rural community or another rural community within Oregon. Your role is perhaps the most important of all in their clinical rotation. Their University will give them the tools that they need to be successful, our providers will teach them how to provide excellent hands-on patient care, and from you they will learn how to combine those skills with the compassion needed to make a difference in health outcomes. For that we would like to take this opportunity to thank you.

Billing Tips

Dear Evergreen Family Medicine Patients,

We are so happy to be able to reach out and communicate on how we can work together to make sure that we are not only providing great care but excellent service with your billing. Below are helpful tips that we hope will help accomplish this.

Call or go online with your insurance and ask the following:

1.) Is my provider in network or out of network?

This can change how the insurance pays on your claim.

2.) Does my insurance require me to choose a PCP (Primary Care Physician)?

3.) Do I have a Co-pay? How much?

This is usually a fixed amount you pay whenever you receive certain health care services or get prescription drugs. Copays may apply before and after you hit your deductible. A copay is different from coinsurance, which only applies after reaching your deductible and is the percentage of your final bill that you pay.

4.) What is my deductible?

This is the amount you pay for covered health care services before your insurance plan starts to pay.

5.) What services are considered preventative care?

This is the care you receive to prevent illnesses or diseases. These services are usually covered for free and include such things as screening and immunizations.

6.) Do I have a primary and a secondary insurance?

Secondary Insurance is a health insurance plan that covers you in addition to your primary

insurance plan. Typically, secondary insurance is billed when your primary insurance plan is

exhausted and may help cover additional health care costs. For example, if you already have

insurance through your employer and choose to enroll with your spouse’s health insurance plan (if allowed), that coverage would become your secondary insurance. It is so important to provide a copy of the insurance cards and clearly communicate which is primary and which is secondary. Make sure that you instruct that card to be applied to all family members under that plan.

7.) COB Coordination of Benefits policies create a framework for two insurance companies, if you have two, to work together to coordinate benefits so they pay their fair share. The primary plan pays its share of the costs first. Then, the secondary insurer may pay up to 100% of the total cost of care, as long as, it's covered under the plans. It is extremely important that you communicate to both plans and make sure they know about the other. It is also imperative that if you cancel or if there is a change that you communicate to the other plan.

8.) Billing your Insurance is a courtesy. We accept assignment of benefits for primary and secondary insurance. It is your responsibility to provide our office with complete and accurate insurance or billing information at the time of service. Our office cannot guarantee the amount that an insurance company will pay. Your insurance is a contract between you and the insurance company. We are not a party to this contract. We do not guarantee payment.

We know these are tough times, did you know we offer monthly payment plans?